How We Deliver Financial Planning

Here’s What Our First Few Meetings Look Like

1. First Meeting – Let’s Get Acquainted

This is a relaxed, no-pressure session where we get to know each other. You’ll tell us a bit about your situation, and we’ll share how we work, what we offer, and what it costs. It’s totally free and takes about an hour.

2. Second Meeting – Let’s Get Organized

If you decide to move forward, our next step is helping you get a handle on all your financial stuff. We know most people don’t have everything neatly filed—maybe some things are stuffed in drawers or buried in a pile. That’s completely normal.

Just bring whatever you can easily grab—statements, policies, even a box of papers or unopened mail. We’ll sit down together and sort through it. If your accounts are online, we’ll help track those down too. The goal is to get everything in one place so we can start putting your plan together.

3. Third Meeting – Your Plan & Next Steps

About a week later, we’ll get back together to go over your personalized financial plan. We’ll walk through our recommendations and talk about how to move forward.

You can have us take the lead on putting the plan into action, or we can guide you while you handle the details. We can also coordinate with other pros you might be working with—like lawyers or brokers. If we’re the ones keeping tabs, we’ll check in now and then to make sure everything stays on track.

What Is A Financial Plan?

A financial plan is a personal document created to help:

- Assess your current financial situation.

- Determine what you want to accomplish with your finances.

- Help you make better financial decisions in the future.

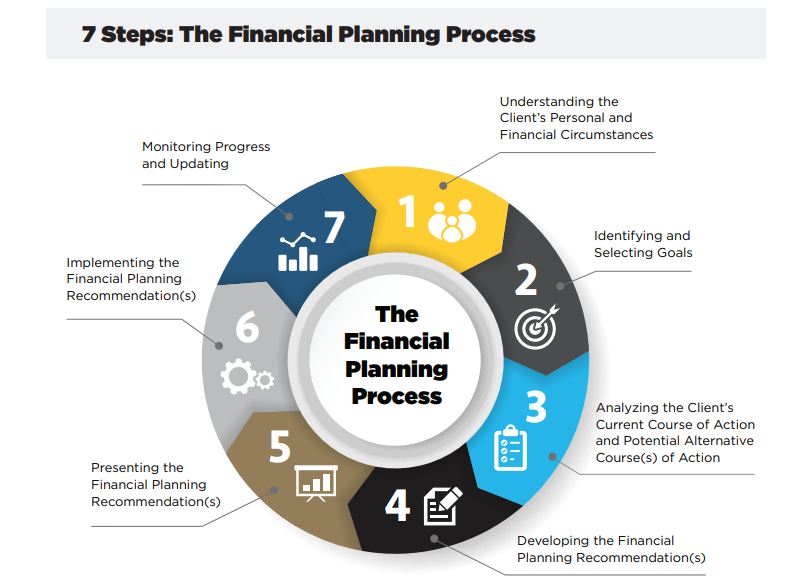

According to the CFP Board, the financial planning process is defined as:

“A collaborative process that helps maximize a Client’s potential for meeting life goals through Financial Advice that integrates relevant elements of the Client’s personal and financial circumstances.”

Why Is a financial plan Important?

During the financial planning process, you learn quite a bit about your overall financial health. Without building your personal plan, you might not have even realized you were in rough shape.

Financial planning is important because it helps you identify and prioritize your goals.

It also aims to give you a complete picture of your financial situation and identify changes you may need to make to increase your likelihood of achieving your goals—for example, which account types and financial products make sense for your personal situation.

Some advantages of investing, like compounding potential returns, are realized over time, so having a plan and starting early is important for the long term.

A financial plan can also help you uncover vulnerabilities, like not having enough saved in an emergency fund or being underinsured.

It may also make you feel more confident and comfortable about your investment portfolio’s choices when the markets fluctuate.

That’s why having a financial plan is important for people of all ages and financial backgrounds—not just older, wealthy people.

eMoney Advisor™ is Amazing

INTRODUCING eMONEY ADVISOR™

FOR CLIENTS OF SEASTRUNK FINANCIAL MANAGEMENT

Available to Seastrunk Financial clients, you can use eMoney to organize your financial life with your own digital wealth management portal.

Features include:

- A consolidated view of everything you own and everything you owe; Updated daily;

- The ability to track spending habits, set a budget, and monitor cash flow to stay on the right track;

- Use our document vault to securely store and share investment statements, estate planning documents, and tax returns.

- Comprehensive financial planning platform. eMoney Advisor provides a suite of tools that help us create, monitor, and update financial plans for you, from basic to complex.

- Client portal and engagement. eMoney Advisor lets us share financial plans, reports, documents, and messages with you through a secure and interactive portal. We can also use features like screen sharing, goal planning, lead capture, and gamification to enhance your experience.

- Data aggregation and reporting. eMoney Advisor collects and updates data from over 20,000 sources, including bank accounts, investment accounts, insurance policies, loans, mortgages, and more. We can use this data to generate comprehensive reports and insights for you.

- Security and compliance. eMoney Advisor uses industry-leading security measures to protect your data, such as encryption, firewalls, backups, audits, and multi-factor authentication.